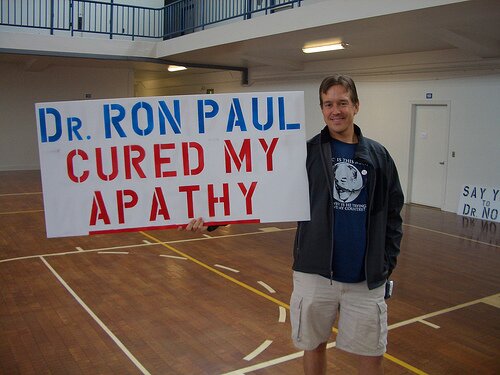

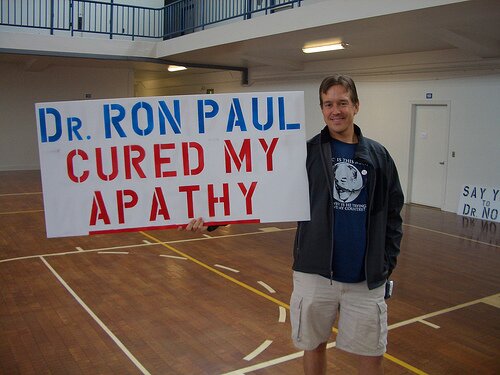

Another Successful Cure

I think it is a shame that everyone seems to be fixated on the dust-up between the Barr camp and Ron Paul. It threatens to overshadow the significance of the meeting Ron held (and Barr bagged out on) where he introduced, again, the case for the principles of Liberty over the politics of expediency.

The list of points of agreement that Ron, Ms. McKinney, Mr. Baldwin, and Mr. Nader endorsed is a call to effect a cure rather than treating (or, not treating) the symptoms. (a side note, it is roughly analogous to my SSS plan for energy and environment)

John Walsh had a great post on LRC today where he sums up the four points;

- Foreign Policy: The Iraq War must end as quickly as possible with removal of all our soldiers from the region. We must initiate the return of our soldiers from around the world, including Korea, Japan, Europe and the entire Middle East. We must cease the war propaganda, threats of a blockade and plans for attacks on Iran, nor should we re-ignite the cold war with Russia over Georgia. We must be willing to talk to all countries and offer friendship and trade and travel to all who are willing. We must take off the table the threat of a nuclear first strike against all nations.

- Privacy: We must protect the privacy and civil liberties of all persons under US jurisdiction. We must repeal or radically change the Patriot Act, the Military Commissions Act, and the FISA legislation. We must reject the notion and practice of torture, eliminations of habeas corpus, secret tribunals, and secret prisons. We must deny immunity for corporations that spy willingly on the people for the benefit of the government. We must reject the unitary presidency, the illegal use of signing statements and excessive use of executive orders.

- The National Debt: We believe that there should be no increase in the national debt. The burden of debt placed on the next generation is unjust and already threatening our economy and the value of our dollar. We must pay our bills as we go along and not unfairly place this burden on a future generation.

- The Federal Reserve: We seek a thorough investigation, evaluation and audit of the Federal Reserve System and its cozy relationships with the banking, corporate, and other financial institutions. The arbitrary power to create money and credit out of thin air behind closed doors for the benefit of commercial interests must be ended. There should be no taxpayer bailouts of corporations and no corporate subsidies. Corporations should be aggressively prosecuted for their crimes and frauds.

Often the most effective cures are negative, epitomized by the old joke where the patient describes a pain that occurs when he does a certain action, to which the physician makes a commonsense reply. Let’s apply this to the four points;

Patient – “Doctor, when I garrison the globe with 800 bases in 150 countries, and meddle in the internal affairs of other countries, terrorists keep trying to blow me up! What do I do?”

Doctor – “Stop doing that.”

Patient – “I keep trading liberty for security, yet while I am less free, I am no more secure, what do I do?”

Doctor – “Stop doing that.”

Patient – “I am so in debt I have to borrow money from my business adversaries just to stay afloat. In addition, I am saddling my estate with debt so that my children will be sent to the workhouse to work off my debts for the rest of their lives, and their children, and their children. What do I do?”

Doctor – “Stop doing that.”

Patient – “I have been passing bad checks and counterfeiting bills to paper over my debt and fund my extravagant lifestyle. So far I haven’t been caught yet, but I have noticed that my counterfeits don’t buy nearly as much as they used to, and my neighbors are all dressed in rags and their home is being foreclosed, what do I do?”

Dr. Paul – “Are you dense? Haven’t you been listening to my advice for the past 30 years? STOP DOING THAT!”

Hurricane Ike, And Federal Help

Road Humps Indeed

A note from a friend, Houston, TX area resident Phil Schawe (SHAHvee) had this to say about the aftermath of Hurricane Ike;

And the ultimate comment;

(PHOTO: Phil’s amazing Flickr set )